The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made. There may be an escrow account involved to cover the cost of property taxes and insurance. The other portion is the interest, which is the cost paid to the lender for using the money. A portion of the monthly payment is called the principal, which is the original amount borrowed. Each month, a payment is made from buyer to lender. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S. Lenders define it as the money borrowed to pay for real estate. MortgagesĪ mortgage is a loan secured by property, usually real estate property. The calculator is mainly intended for use by U.S. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. You may be denied at a federally regulated lender if you fail the stress test when transferring over, such as if your income has dropped.The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Provincially regulated credit unions, quasi-regulated B Lenders, and private lenders are not required to conduct a mortgage stress test.

A mortgage stress test is not required if you renew your mortgage at the same lender.

Switching to a new lender also requires you to pass a mortgage stress test if the lender is federally regulated. Your new lender may cover these transfer costs.

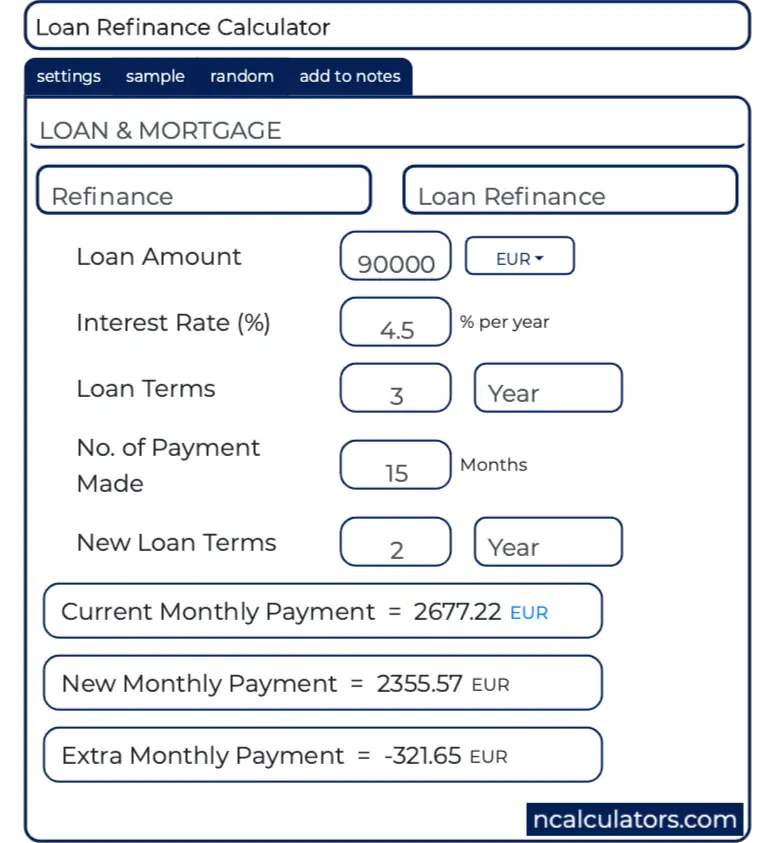

#REFINANCE CALCULATOR REGISTRATION#

There are costs to changing mortgage lenders that may be charged, such as appraisal and registration fees. This can be due to a variety of reasons, such as a better mortgage rate offered by another lender, or mortgage terms that are more suitable for you (e.g. If you no longer want to stay with the same mortgage lender at renewal, you can always switch to another mortgage lender. You can always negotiate for a better interest rate than the one stated in your mortgage statement before your mortgage is renewed especially if you do shop around and show them a lower rate from a competitor Switching Mortgage Lenders at Renewal The terms listed on your mortgage statement will apply, which may not be the best current mortgage rate in Canada. Be aware that your mortgage renewal can be automatic, even if you do not take action on your end. You will receive a mortgage statement before renewal that contains information such as the principal remaining, new offered interest rate, and term length if your lender is federally regulated.

#REFINANCE CALCULATOR HOW TO#

How to make sure to get the best mortgage renewal RBC, TD, CIBC, and BMO all allow principal prepayments of any amount at the time of renewal without prepayment penalties. Mortgage prepayment allowances depend on your lender. If you do not use your limit in one year, you cannot apply it to the next year.

If your mortgage lender is federally regulated, payment privileges must be clearly displayed in your mortgage agreement contract.Īnnual prepayment limits do not roll over. Prepayments may be limited to a single lump-sum payment per year at some lenders. Some lenders offer prepayment privileges that will allow you to pay up to a certain amount of the principal, with that amount directly paying down the principal. Closed mortgages offer a lower interest rate, but it can come with prepayment charges depending on the amount. Open mortgages allow you to prepay before the end of the term without incurring prepayment charges, however they come with higher mortgage interest rates. You can pay off 0 to 20% of your mortgage before renewal depending on your current mortgage contract. While you can change the mortgage interest rate, payment frequency, and term length when negotiating your renewal, your mortgage principal balance will remain the same.

0 kommentar(er)

0 kommentar(er)